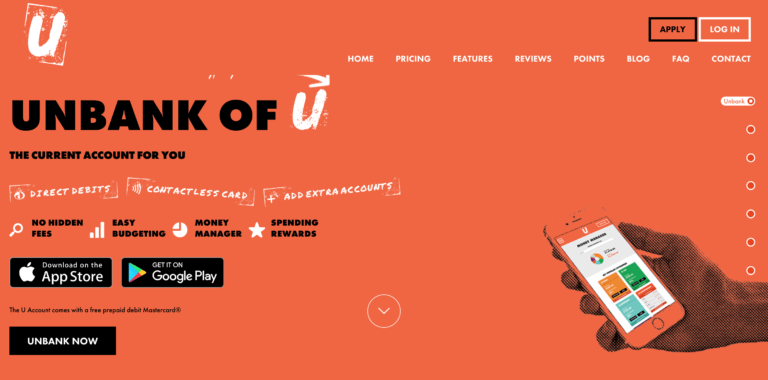

There are different options when it comes to getting a bank account for your kids. It’s tempting to go to the main stream high street banks but they tend to only offer only limited accounts.

There has been an emergence of Smartphone Apps recently that are linked to a pre paid debit card. In many cases we have found this to be a better option. As they tend to come with a contactless card it’s a good way to get your child used to managing electronic money systems.

There are different options when it comes to getting a bank account for your kids. It’s tempting to go to the main stream high street banks but they tend to only offer only limited accounts.

There has been an emergence of Smartphone Apps recently that are linked to a pre paid debit card. In many cases we have found this to be a better option. As they tend to come with a contactless card so it’s a good way to get your child used to managing electronic money systems.

Cash Is King…. For Now

Cash is still the primary way that most people pay for things but year on year it’s in decline. Prepaid debit cards like Go Henry, Osper and the like allow your child to withdraw from UK cash machines.

This is great news as it’s not an either or option when it comes to making a decision between choosing a bank account for your kid and a smartphone app.

For me it’s getting your child in to the habit of checking their finances on a daily and weekly basis. Learning to manage a budget and whether or not you are paying in cash or on card, it’s the discipline that comes with it that it the key.

The Difficulty With Card Purchases

Part of the struggle when you pay for everything on a card is that it’s hard to know when you have overspent. The good things about apps like Go Henry and Osper are that you can’t overspend on the card.

If your child has a smartphone they can have access to the app and then keep track of their spending.